Executive Summary

Stock

investment occurs hundreds of thousands of times every day. There are entire

firms dedicated to searching for undervalued stocks and investing client assets

accordingly. These investment funds have a variety of methods for evaluating

stocks and making investment decisions.

Whether

or not I work in an investment fund or similar area of business I will be

making investments in the stock market throughout my life. I wanted to create

my own system for evaluating stocks and recommending investment amounts based

on optimal portfolio weights.

The

“Stock Evaluation and Portfolio Optimization” workbook I created contains VBA

code that accomplishes three main tasks.

1. Gather

data on all S&P 500 stocks

2. Evaluate

and recommend stocks based on the gathered data

3. Optimize

portfolio weights for the recommended stocks

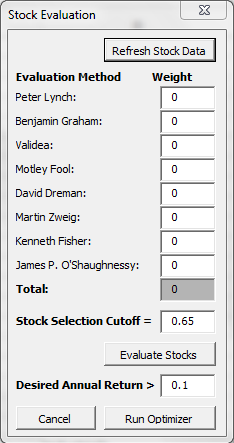

These tasks can

be accomplished through the “Stock Evaluation” user form (see below) that is

launched by clicking the button on the customized “Stock Analysis” ribbon. The

“Refresh Stock Data” button on this form accomplishes the first task by

collecting performance data on each of the S&P 500 stocks according to 8

different stock evaluation methods. The “Evaluate Stocks” button undertakes the

second task by scoring stocks against these 8 evaluation methods using weights

and a cutoff measure supplied by the user. The “Run Optimizer” button then uses

Excels Solver add-in to optimize portfolio weights to achieve the lowest

standard deviation possible subject to the desired annual return supplied by

the user.

Together these

procedures allow the user to evaluate a vast number of stocks and to know how

to invest in those stocks in a risk-conscious way. The rest of this report

details how to work the user form and the processes employed to accomplish the

three tasks outlined above.

Report: http://files.gove.net/shares/files/14w/aweaver2/Stock_Evaluation_and_Portfolio_Optimization.pdf

Excel File:http://files.gove.net/shares/files/14w/aweaver2/Stock_Evaluation_and_Portfolio_Optimization.xlsm

No comments:

Post a Comment